Personal Financing

At the heart of our mission is a commitment to offering innovative, flexible, and customer centric financial solutions that meet the diverse needs of our clients. In an ever-evolving financial landscape, it is essential to have access to the best possible tools and strategies for managing your financial growth and stability. That’s why we’ve crafted a financing model that integrates the power of OPM (Other People’s Money), enhanced by our strategic partnership with SoFi, to deliver a superior loan experience.

OPM: Explanation Of Benefits That Can Change Your Future.

One of the most important tools for gaining mastery of wealth and ensuring personal prosperity is Other People’s Money or OPM. This is just what it sounds like—money that belongs to other people. How can it help you to join the rich? Easy. By investing with OPM, you can control much larger assets. Controlling more and larger assets lets you boost cash flow faster, more reliably and, ultimately, more effectively than if you used only your own money. So, strange as it may sound, using what isn’t even yours is essential to your investing success.

Rich dad taught Robert about the ability to “lift” large investments by using Other People’s Money or OPM. “Leverage is the reason some people become rich, and others do not,” rich dad said. He went on to point out, “The reason less than 5 percent of all Americans are rich is because only 5 percent know how to use the power of leverage. Many, who want to become rich, fail to become rich because they abuse the power. And most people do not become rich because they fear the power of leverage.” However, keep in mind that leverage can hurt you as well as help you. The difference is whether one applies it to good debt or bad debt.

Rich dad said, “There is good debt and bad debt. Good debt makes you rich and bad debt makes you poor.” Bad debt is debt that does not increase cash flow or that reduces cash flow. Bad debt is charging a restaurant meal on a credit card or buying a boat on an installment plan. Good debt is using OPM to pay for new production equipment that increases a business’s sales and profits, or purchasing a property that can be rented to generate positive cash flow Unfortunately, most people are loaded with bad debt. Others, equally misguided, live in fear of debt and strive to be completely debt free. Neither approach is best. While bad debt can put and keep you in the Rat Race, good debt can break you out. This is why Robert loves good debt. With the leverage afforded by good debt and OPM, he can do more with less. And so can you.

Rich Dad Coaching (2014). Rich Dad’s Guide To Investing With Other People’s Money. 2-3.

GRHE Has Partnered With SoFi

![]()

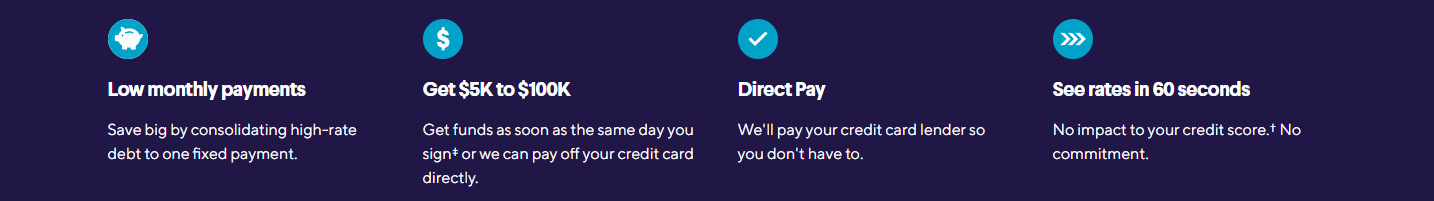

Personal loans are a type of installment loan issued by banks, credit

unions, or online lenders and typically range from $5K-$100K. Borrowers

receive a lump sum of money that they then pay back in regular, fixed

payments over a set term.

Unlike a mortgage or auto loan, personal loans are flexible, this means

you can use the money for just about anything you want.

Keep in mind that personal loans can be used to cover big expenses or

consolidate high-interest debt with a more favorable rate.

As you begin to research your options, you’ll discover there are diƯerent

types of personal loans. The type you choose may depend on the amount

you plan on borrowing, your credit and financial history, the amount of

debt you currently have, and other factors.

SoFi Low rates. No fees required. Personal loans made easy online.

Get funds as soon as the same day you sign with our quick, easy application process.

Funding Doesn't Have to Be Complicated.

Ready to take control of your financial future? Discover how we can help you navigate the world of credit, secure funding with ease, and unlock new opportunities for your business. It’s time to rewrite the rules of financial empowerment.

The way we use our OPM system is with Grants, Credit Cards and Lines Of Credit. By doing this it will create a pathway to FINANCIAL FREEDOM.

Our formula to create FINANCIAL FREEDOM;

We Also Harness The Power Of AI For A Smarter Loan Experience

At GRHE, we integrate Artificial Intelligence (AI) into every aspect of the loan process, ensuring that our clients receive the most efficient, personalized, and competitive lending solutions available. Our advanced AI technology analyzes market trends in real-time, enabling us to offer customized loan options that best suit individual financial needs. This cutting-edge approach not only enhances decision-making but also significantly reduces approval times, giving our clients a seamless experience.