Personal Tradelines

At GRHE, we have always been driven by a passion for innovation, and that passion led us to take a bold step in transforming the way tradelines are developed and utilized within the financial sector. Recognizing the limitations and inefficiencies in traditional tradeline management, we set out to create our own proprietary in-house tradelines, backed by the unparalleled capabilities of Artificial Intelligence.

What Are Tradelines and How Do They Affect You?

A tradeline is another name for an account listed on your credit reports. Tradelines include several pieces of information that can indicate how you manage your debt.

A tradeline is a term used by credit reporting agencies to describe credit accounts listed on your credit reports. For each credit card, loan and other type of credit account you have, you'll have a separate tradeline that includes key information about the creditor and the debt.

Understanding how tradelines work can give you a better idea of how to read your credit report and what lenders consider when they check your credit.

How Tradelines Affect Your Credit Score

Tradeline information is the basis of your credit score, so it directly affects your credit health in several ways. Here's how based on the main credit score factors:

What Are Tradelines on Your Credit Report?

Your credit report provides a history of your dealings with different types of accounts, including the following:

Revolving tradelines include credit cards and lines of credit, which don't have fixed repayment terms and allow you to pay down and reuse your available credit in a revolving manner.

Installment tradelines are loans with fixed disbursements and repayment terms. They include mortgage loans, auto loans, student loans and personal loans.

If a lender sells a revolving or installment credit account to a collection agency, it'll show up as a separate tradeline.

It's important to note that you'll have tradelines on your credit reports for accounts where you're the primary borrower, as well as accounts where you're a cosigner or an authorized user.

Lenders and collection agencies regularly report information about credit accounts to the credit bureaus, which then add the information to your report. This allows you and others, such as prospective lenders, employers and landlords, to view relevant information about all of your debts in one place.

Lender's name and address

- Type of account

- Partial account number

- Current status

- Date the account was opened

- Date the account was closed, if applicable

- Date of last activity

- Current balance

- Original loan amount or credit limit

- Monthly payment

- Recent balance (for credit cards only)

- Payment history

Keep in mind, however, that lenders may differ in how they report your information, so you might see some variations in information across tradelines.

Example Guide

These Are Examples ONLY

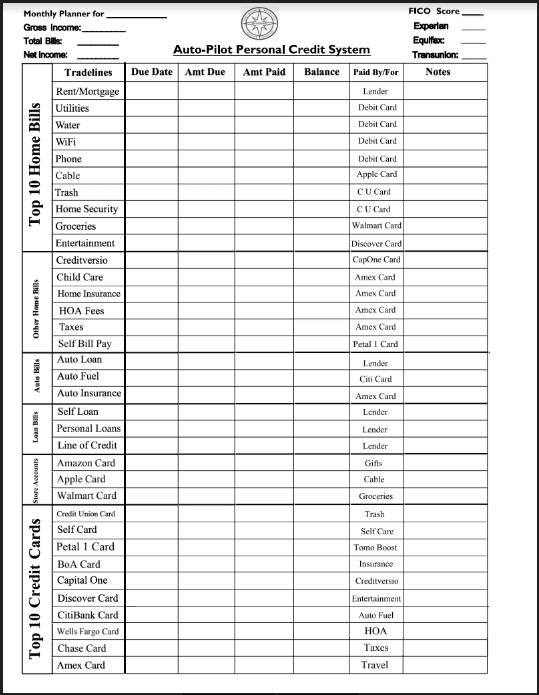

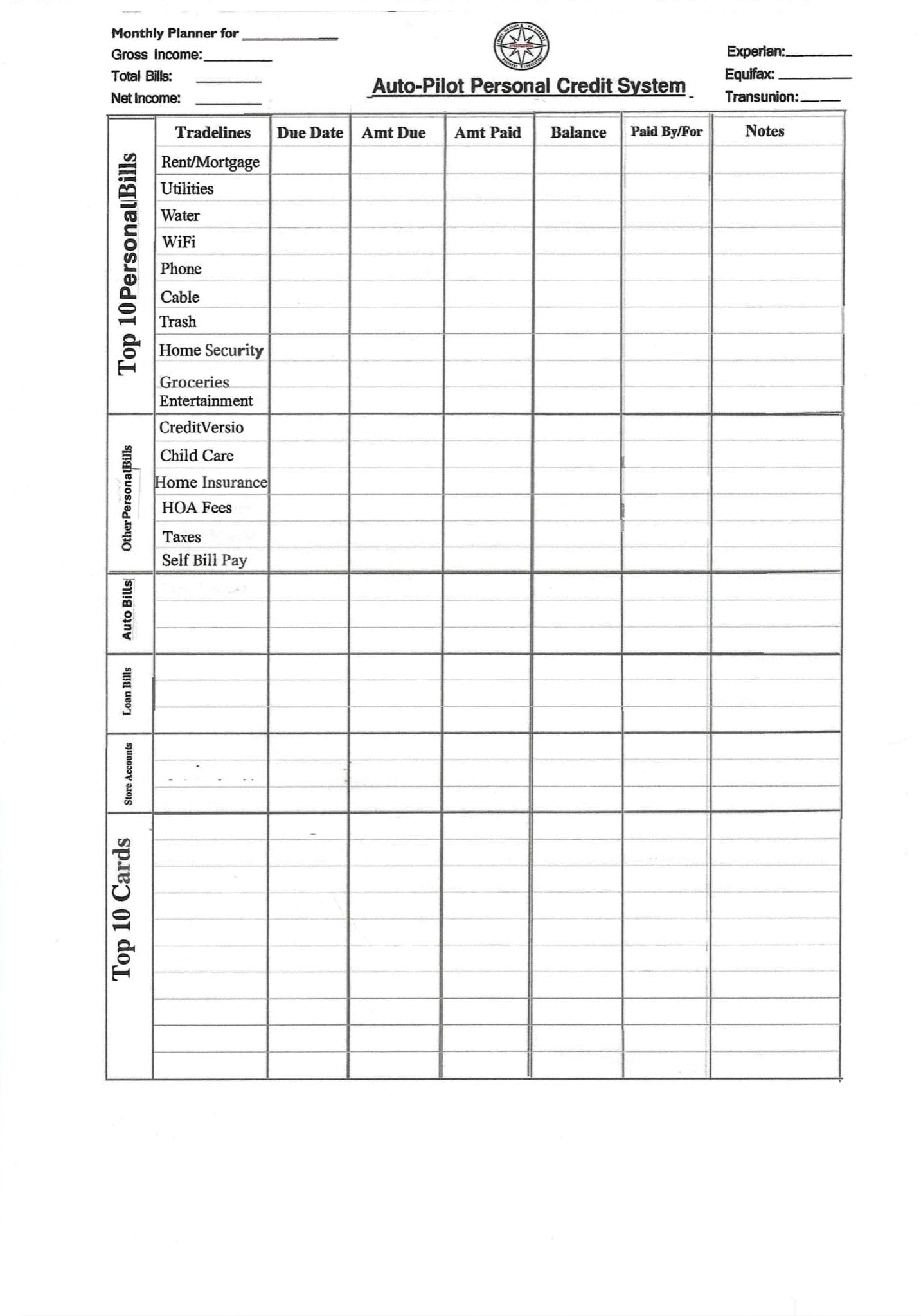

Auto Pilot Personal Credit System

This is a package of Legal Primary Tradelines created by Artificial Intelligence, and they are best mix of tradelines to help you boost your personal FICO Score above the 800 range.

This Autopilot Form shows you how to pay all of your bills with Credit Cards and automate all of your expenses.

You will need to manage, and control a good mix of about 15-20 personal tradelines, to achieve a FICO score of 800 and higher.

It’s a form you could use in many ways to track and control all your personal finance.

Fillable Reference Guide

We Recommend Adding These Tradelines To Build A Stronger Personal Credit Profile, And To Reach A 800 FICO Score

Personal Tradelines

| Name | Website | Notes |

|---|---|---|

| Navy Federal Credit Union | https://www.navyfederal.org/ | |

| Rent | https://learn.self.inc/ | |

| Utilities | Electric, Water, Trash, Phone, Wifi, Cable, Home Owner’s Insurance | |

| Smart Credit | https://www.smartcredit.com/ | |

| Self Credit Loan | https://www.self.inc/ | |

| Self Bill Pay | https://learn.self.inc/ | |

| Self Credit Card | https://www.self.inc/visa-secured-credit-card | |

| Merrick Credit Card | https://merrickbank.com/ | |

| Amazon Credit Card | https://amazon.com/ | |

| Capital One Card | https://www.capitalone.com/credit-cards/ | |

| Citi Bank Credit Card | https://www.citi.com/ | |

| Discover Credit Card | https://www.discover.com/ | |

| Amex Credit Card | https://www.americanexpress.com/ | |

| High Limit Credit Cards | ||

| Personal Line Of Credit |

Buying tradelines opens you to unnecessary risk

Buying a tradeline is sometimes presented as a credit repair strategy. It involves paying a third-party service to add you to another person’s tradeline, so that their tradeline information appears on your credit report, represented as your own. These are short-term agreements, so you’re removed from the tradeline after a designated amount of time.

It might seem similar to becoming an authorized user on someone’s account, but there are two key differences:

While it’s technically not illegal, buying a tradeline isn’t exactly ethical either. Many creditors consider it to be misrepresentative, and the practice poses some risks for borrowers, like identity theft. FICO® 8 has made efforts to lessen the impact that bought tradelines have on someone’s credit score, making it even more unclear how helpful a strategy this would be.

Tradelines offer a number of benefits when used properly. You will see unmatched returns on your business. It is only possible to achieve this by closely following the rules and regulations.

Gonzalez-Ribeiro, A. MBA, AFC® (2023). What Is a Tradeline & How Does It Impact My Credit Score? Self.INC Article

We Are Tradeline Specialists

At GRHE, we believe that the integration of Artificial Intelligence into our in-house tradeline creation process is not just a step forward but a transformative leap for the financial services industry. We’ve set out to revolutionize the way tradelines are designed, managed, and utilized, and through our commitment to leveraging cutting-edge AI technology, we are redefining the standard for excellence in this field.