Business Tradelines

Discover how the tailored approach to business credit can help you establish and maintain a robust credit profile with GRH Enterprises. From legal primary tradelines to business grants and credit card options tailored to your industry, we empower businesses with strategic tools to optimize their creditworthiness and achieve financial stability.

Business Tradelines

Business Tradelines – also known as trade references or trade information – are accounts that appear on business credit reports.

The financial tradelines of your company are those reported by a bank, credit union, or financial institution. Financial tradelines outline your company’s history of obtaining and repaying (or missing payments on) financial products such as a business credit card, loan, lease, or line of credit.

Additionally, business credit reports can include vendor tradelines. Tradelines are also known as merchant, corporate, or supplier tradelines. Vendor tradelines are the net payment accounts you may have with vendors and suppliers.

As an example, if you open a net-30 account with a vendor, you have 30 days to pay an invoice. The credit report of your company may show how much credit you used and whether you made your payments on time or late.

Business Credit Bureaus

Why are Tradelines Important?

Business tradelines can be important since they give other companies and organizations a sense of your creditworthiness.

Credit reports may include an overview of your company’s history of paying its bills and accounts.

Additionally, they often have information about the business, such as how old it is, what its industry is, and whether there are outstanding liens or judgments.

When you apply for a loan, line of credit, lease, insurance, or trade credit, someone may review your business’s credit report. When you are trying to get a contract with a major corporation or government agency.

A lot of business credit reports include business credit scores or creditworthiness ratings, and your tradelines can directly impact these.

D&B Paydex Score, for example, ranges from 1 to 100. To get a score of 80, you must pay your trade accounts on time. Getting a better score requires you to pay early than the trade credit accounts require.

Get a Trade Line on Net 90 Terms: Our list of Net 90 vendors will help you business credit line on Net 90 terms. You can make payment after 90 calendar days of invoice.

Benefits of Business Tradelines

5 Things you should know about Business Tradelines

Example Guide

These Are Examples ONLY

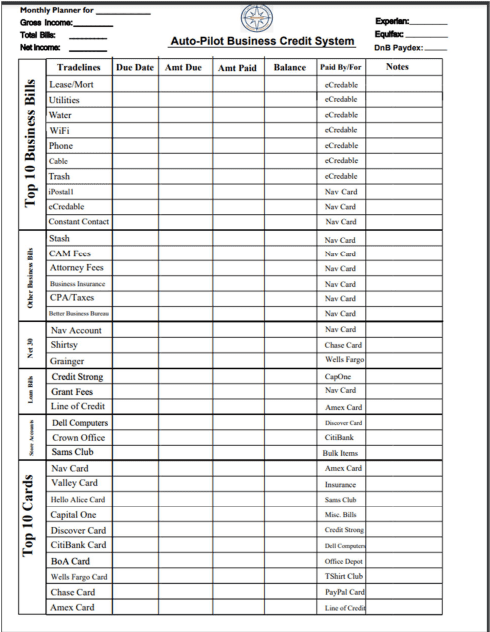

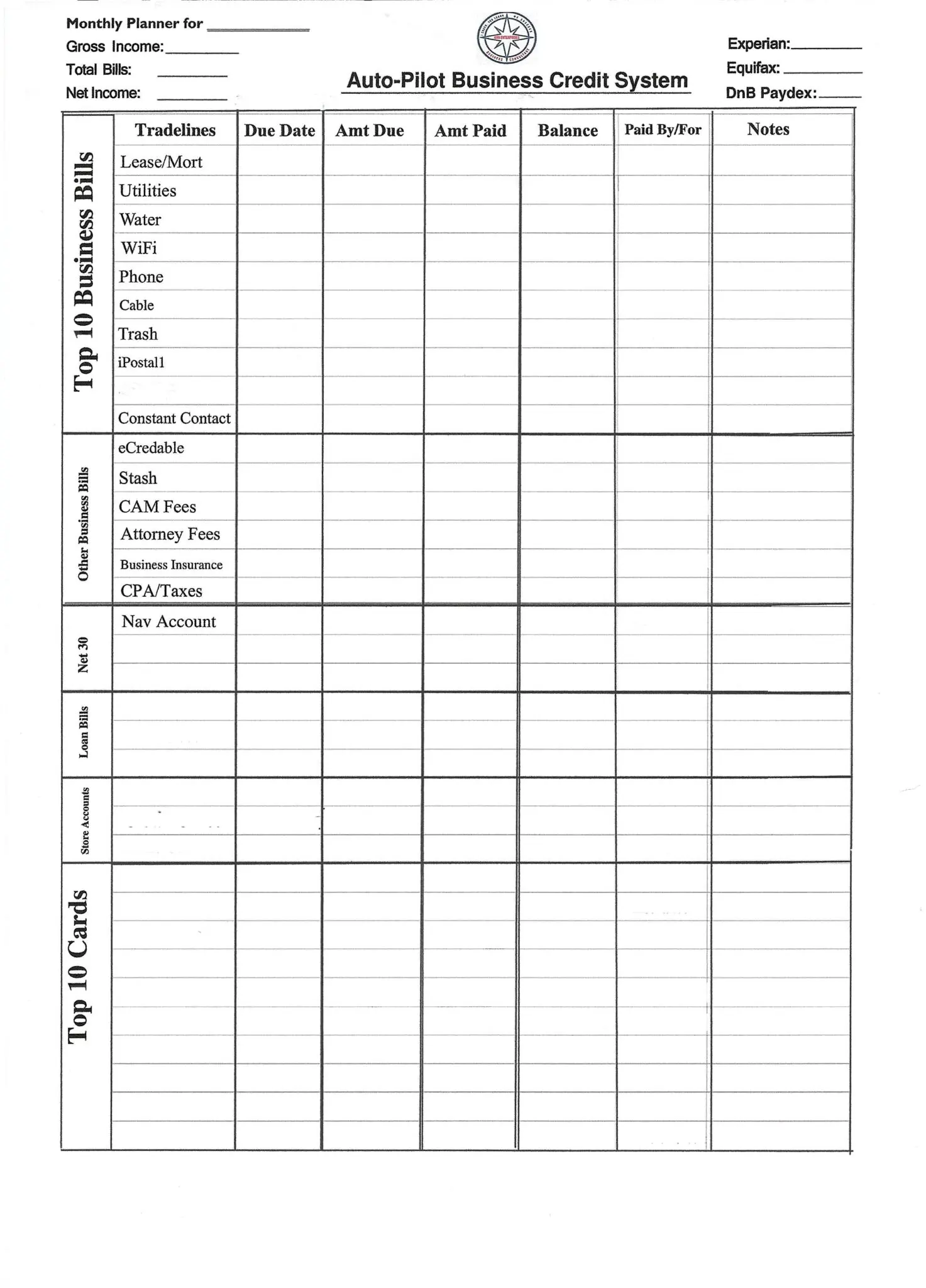

Auto-Pilot Business Credit System

This is a package Legal Business Tradelines created by Artificial Intelligence, and they are best mix of tradelines to help you boost your Business Paydex Score above the 80 range.

This Autopilot Form shows you how to pay all your bills with Credit Cards and automate all of your expenses.

You will need to manage, and control a good mix of about 15-20 business tradelines, to achieve a Paydex score of 80 and higher.

It’s a form you could use in many ways to track and control all your business finances.

Fillable Reference Guide

We Recommend Adding These Tradelines To Build A Stronger Business Credit Profile

This guide is designed to help you build your Business Credit Profiles and secure funding. It outlines the necessary actions and instructions for each step of the process during the 90-day program.

Each month, you will complete specific tasks to prepare your profiles for funding. Once all steps are completed, your profiles will move into the funding phase, which typically takes 1–2 weeks.

After securing funding, you'll be ready to purchase your eCommerce store. Congratulations on successfully preparing your Business Credit Profiles and automating your financial and credit systems!

Affiliate Partner Business Tradelines

| Name | Website | Notes |

|---|---|---|

| Nav.com | https://www.navchecking.com/ | |

| Nav Prime Card | https://www.nav.com/ | |

| Grants | https://helloskip.com/ | |

| IPostal | https://ipostal1.com/ | |

| Zen Business | https://www.zenbusiness.com/ | |

| Shirtsy | https://shirtsy.com/ | |

| Credit Strong | https://www.creditstrong.com/ | |

| NFBO Card | ||

| Capital One Spark | https://www.capitalone.com/ | |

| Amazon Business Card | ||

| Lender Credit Cards |

Ecommerce Store Business Tradelines

| Name | Website | Notes |

|---|---|---|

| Nav.com | navchecking.com | |

| Nav Prime Card | nav.com | |

| Grants | ||

| Sam’s Club | samsclub.com | |

| Hello Alice | helloalice.com | |

| Shirtsy | shirtsy.com | |

| Credit Strong | creditstrong.com | |

| Legal Shield | legalshield.com | |

| Valley Bank | valley.com | |

| Bank of America Card | bankofamerica.com | |

| Credit Cards |

Existing Business Tradelines

| Name | Website | Notes |

|---|---|---|

| Grants | ||

| NET 30 For Your Industry | ||

| Legal Shield | https://www.legalshield.com/ | |

| Credit Strong | https://www.creditstrong.com/ | |

| Nav.com | https://www.navchecking.com/ | |

| Nav Prime Card | https://www.nav.com/ | |

| Ebay Credit Card | https://pages.ebay.com/ | |

| Chase Ink | https://creditcards.chase.com/ | |

| Metro Credit Card | https://www.metrocu.org/ | |

| Credit Cards | Additional Notes And Tradelines |

Buying Business Tradelines is a Bad Idea

If you’re looking for a fast way to build your business credit, you’ll quickly discover there are companies that sell tradelines. These are usually “seasoned” tradelines, meaning they’ve been in business for quite some time.

Generally, the seller will authorize your business to use the tradeline. A shelf company is a company formed on paper that sits on a shelf until it’s sold.

The idea is to purchase a company that has been in operation for a long time and has established credit. As a result, it can qualify for contracts and higher funding limits based on its “history.”.

Although tradelines and shelf corporations aren’t technically illegal, lenders don’t like this practice. If a lender finds out that you used these tactics, you might be in trouble.

Buying tradelines or a shelf company with the intent of misrepresenting your credit history and applying for a loan or credit account could be considered fraud.

Engracia, K. (2024). Business Tradelines That Build Your Business Credit. Wisebusinessplans Build Business Credit Article

Enhancing Your Financial Management Skills

Explore our resources and tools to enhance your financial management skills and achieve your personal and business goals with confidence. Call us today for more information about